Investment Funds and Financial Stability: Policy Considerations Departmental

Investment funds play a significant role in modern financial markets, facilitating capital flows and providing investment opportunities for a wide range of investors. However, the rapid growth and increasing complexity of investment funds have raised concerns about their potential impact on financial stability.

5 out of 5

| Language | : | English |

| File size | : | 2498 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 106 pages |

This article explores the relationship between investment funds and financial stability, examining the risks and vulnerabilities associated with different types of funds and discussing the policy considerations necessary to mitigate these risks.

Types of Investment Funds and Associated Risks

Investment funds come in various forms, each with its own unique risk profile. Some of the most common types include:

- Mutual funds: Open-ended funds that pool money from multiple investors and invest in a diversified portfolio of assets.

- Exchange-traded funds (ETFs): Similar to mutual funds, but traded on stock exchanges like individual stocks.

- Hedge funds: Closed-ended funds that use advanced investment strategies and often leverage to generate high returns.

- Private equity funds: Invest in private companies and typically have a long investment horizon.

- Real estate investment trusts (REITs): Invest in income-producing real estate and distribute dividends.

While investment funds can provide investors with diversification and potential returns, they also carry certain risks:

- Market volatility: Investment funds are subject to market fluctuations, which can lead to losses in value.

- Redemption risk: Mutual funds and ETFs face the risk of large redemptions, which can force them to sell assets and potentially disrupt markets.

- Concentration risk: Some investment funds may concentrate their investments in a specific sector or asset class, increasing their vulnerability to downturns in that sector.

- Leverage risk: Hedge funds and private equity funds often use leverage to amplify returns, which can exacerbate losses during market downturns.

- Interconnectedness: Investment funds may invest in each other, creating a complex web of interconnections that can amplify systemic risks.

Policy Considerations for Financial Stability

In light of the potential risks associated with investment funds, policymakers have increasingly focused on developing effective regulatory frameworks to mitigate their impact on financial stability. Some of the key policy considerations include:

- Disclosure and transparency: Enhancing disclosure requirements to provide investors with clear information about the risks and strategies of investment funds.

- Prudent risk management: Implementing regulations that require investment funds to adopt sound risk management practices, including stress testing and scenario analysis.

- Liquidity management: Ensuring that investment funds have sufficient liquidity to meet redemptions, particularly during stressed market conditions.

- Capital requirements: Imposing capital requirements on certain types of investment funds to provide a buffer against losses.

- Monitoring and surveillance: Establishing mechanisms to monitor the activities of investment funds and identify potential risks to financial stability.

Additionally, policymakers are exploring the use of macroprudential tools, such as systemic risk charges, to address the systemic risks posed by investment funds. These tools aim to discourage excessive risk-taking and promote financial stability.

Investment funds play a vital role in financial markets, but their rapid growth and increasing complexity have raised concerns about their potential impact on financial stability. A comprehensive policy framework is necessary to mitigate the risks associated with investment funds, including measures to enhance disclosure, promote prudent risk management, ensure liquidity, and monitor their activities. By addressing these policy considerations, authorities can help to maintain financial stability and protect investors from potential losses.

5 out of 5

| Language | : | English |

| File size | : | 2498 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 106 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia R S Penney

R S Penney Jim Reeves

Jim Reeves Jerry Brotton

Jerry Brotton Salvatore Alessandro

Salvatore Alessandro Robyn Carr

Robyn Carr Siong Guan Lim

Siong Guan Lim James Mallory

James Mallory Frances Hodgson Burnett

Frances Hodgson Burnett Franz Bardon

Franz Bardon Miguel Serrano

Miguel Serrano Julian Stallabrass

Julian Stallabrass Chris Hedges

Chris Hedges Sandy Jones

Sandy Jones Paula Davis

Paula Davis Despina Stratigakos

Despina Stratigakos Jill Castle

Jill Castle Jack Patton

Jack Patton Frank Cascio

Frank Cascio Jim Davidson

Jim Davidson Hiroshi Hiro Yamada

Hiroshi Hiro Yamada

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Hudson HayesLandscape Drawing In Pencil Dover Art Instruction: A Comprehensive Guide to...

Hudson HayesLandscape Drawing In Pencil Dover Art Instruction: A Comprehensive Guide to...

Julio CortázarUnveiling the Atomic Secrets: The Extraordinary Life and Legacy of Wu Chien...

Julio CortázarUnveiling the Atomic Secrets: The Extraordinary Life and Legacy of Wu Chien... Fletcher MitchellFollow ·3.5k

Fletcher MitchellFollow ·3.5k Brent FosterFollow ·11k

Brent FosterFollow ·11k Cason CoxFollow ·10.5k

Cason CoxFollow ·10.5k Pat MitchellFollow ·5.2k

Pat MitchellFollow ·5.2k Terry BellFollow ·7.4k

Terry BellFollow ·7.4k Louis HayesFollow ·2.6k

Louis HayesFollow ·2.6k Ruben CoxFollow ·5.5k

Ruben CoxFollow ·5.5k Brian WestFollow ·3.7k

Brian WestFollow ·3.7k

Howard Blair

Howard BlairHeroes and Villains from American History: The Biography...

David Dixon...

Felipe Blair

Felipe BlairAn Informal History of the 1920s: Uncovering the Roaring...

The 1920s, an era...

Howard Blair

Howard BlairHow a Peculiar Victorian Zookeeper Waged a Lonely Crusade...

In the enigmatic world of Victorian...

Harold Powell

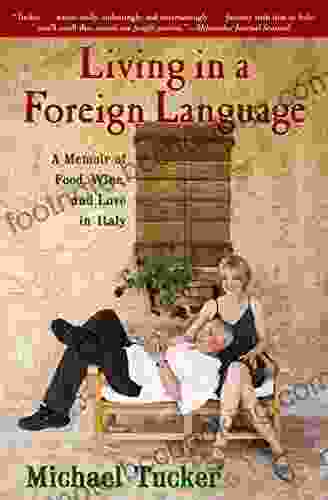

Harold PowellMemoir of Food, Wine, and Love in Italy: A Culinary...

Prepare your senses...

5 out of 5

| Language | : | English |

| File size | : | 2498 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 106 pages |